Understanding "Wrap" and "Subject-To" Offers

By Marcie Lowery

July 31, 2025 at 2:14 PM CDT

Understanding the use of "creative financing" in real estate with Wrap and Subject-To Offers. Knowing about these options can protect both buyers and sellers with their real estate planning!

In the world of real estate, creative financing options can sometimes come across as a solution for both buyers and sellers. Among these options are the Wrap and Subject-To transactions. Understanding their intricacies can help you make informed decisions. Whether you're buying or selling, it's essential to weigh the benefits and drawbacks of each option. As a seasoned REALTOR® with Realty Texas, I can help you navigate these complexities to protect your real estate goals.

Wrap Transactions: A Quick Overview

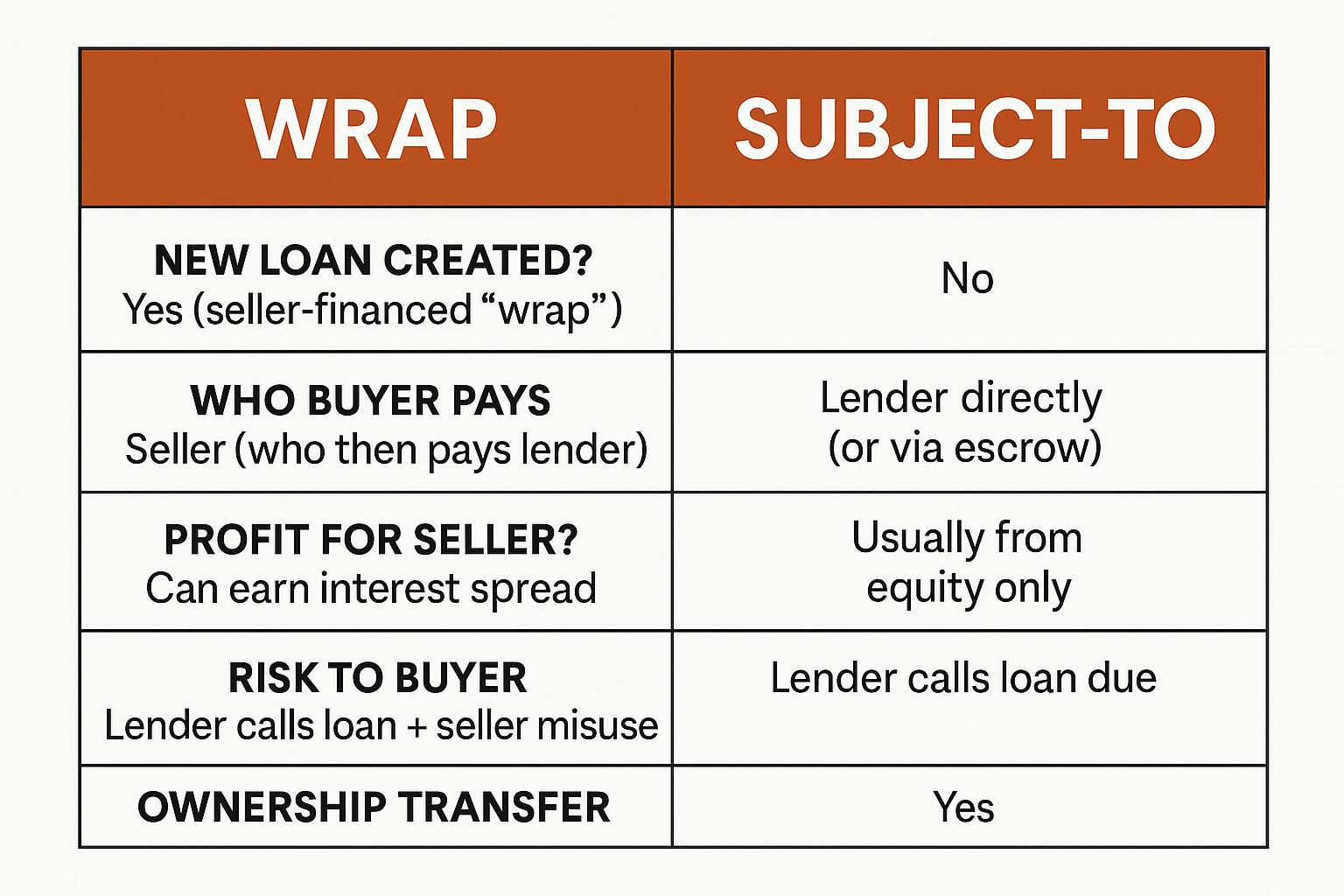

A Wrap transaction involves a seller-financed deal where the existing mortgage is "wrapped" into a new loan to the buyer. The buyer makes payments to the seller, who continues paying the original mortgage. This option can be attractive to both buyers and sellers but carries its own set of pros and cons.

- Pros for Sellers: A Wrap transaction can allow sellers to move their property more quickly by offering flexible financing options to potential buyers. It may also bring higher interest income compared to conventional loans.

- Pros for Buyers: Buyers who may not qualify for traditional financing due to credit issues can benefit from the flexible terms offered in Wrap transactions.

- Cons to Consider: Sellers remain responsible for the original mortgage, which can present risks if the buyer defaults. Buyers face potential complications if the lender discovers the arrangement and enforces due-on-sale clauses.

Subject-To Transactions: What You Need to Know

A Subject-To transaction means the buyer takes over the payment responsibility for the seller's existing mortgage without transferring the loan itself. This can be beneficial in certain situations but also involves a distinct set of challenges.

- Pros for Buyers: A significant advantage is the opportunity to bypass the traditional loan process, allowing for faster occupancy and potential savings on closing costs.

- Pros for Sellers: Sellers can quickly offload a property and its associated financial obligations, which is especially appealing if they're facing financial distress.

- Cons to Consider: Sellers risk the buyer defaulting, which can lead to foreclosure. Buyers agree to terms of the existing mortgage, which might not always be favorable.

Why Choose Me, Marcie Lowery, as Your REALTOR®?

- With numerous transactions under my belt and an expansive knowledge of the Texas real estate market, I have the expertise to guide you through the right approach to protect your property. My comprehensive approach ensures that all potential risks are mitigated while maximizing the benefits for your specific situation. I am committed to providing personalized service that focuses on your unique needs. By collaborating closely with you, I strive to turn complex real estate transactions into seamless experiences. Protecting your real estate goals is my top priority, and I leverage my extensive knowledge to ensure favorable outcomes. Reach out to me for guidance on your real estate goals at (512) 629-0899 or (903) 626-0060 , Email: marcie-lowery@realtytexas.com or my Website https://marcie-lowery.realtytexas.com .

I am not a fan of this type of way to Buy or Sell real estate. The safest way to protect your investment is to secure your own financing with a reputable lender and purchase real estate in your name. Be aware that while this is actually legal to purchase property like this, it is not advised.

Disclaimer: This blog is intended for informational purposes only and should not be considered financial, legal, or real estate advice. It is advisable to consult with a financial advisor or attorney for advice specific to your circumstances. Any transactions involving real estate carry risks, and individuals should perform their due diligence before proceeding.

Comment